EMI Calculator - Calculate Home Loan, Personal Loan, Car Loan EMI in India

Calculate Home Loan, Personal Loan, Car Loan EMI with online EMI calculator in India

| EMI | Rs. 1658 |

|---|---|

| Total Interest | Rs. 10658 |

| Total Payment(Principal + Interest) | Rs. 10658 |

| Principal Amount | 40% |

| Interest Amount | 60% |

Related EMI Calculators

What is EMI?

EMI (Equated Monthly Instalment) is the monthly amount payment we make towards a loan we choosed for. EMI consist of two components: Principal and Interest. The principal is paid against the loan amount that you have opted for. And the interest is paid to the lender as a cost of providing the loan. The sum of principal amount and interest is divided by the number of months, in which the loan has to be repaid. This amount has to be paid monthly. The part of the interest of the EMI would be larger during the starting months and gradually decreases with each payment, with each succeeding payment, you will pay more towards the principal and in interest.

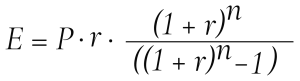

Here is the formula to calculate EMI:

where

E = EMI

P = Principal Loan Amount

r = Rate of interest calculated on monthly basis, (i.e., r = Rate of annual interest / 12 / 100. If rate of interest id 10.5% per annum, then r = 10.5/12/100 = 0.00875)

n = Loan Term/Tenure/duration in number of months

Five things to know about EMI (Equated Monthly Instalment)

- Repayment of a loan is done by paying an equated monthly instalment (EMI) to the Banks/Financial services. EMI depends on three factors: loan amount, interest rate and the duration of the loan.

- The EMI is decided when the loan is sanctioned or authorized and remains constant throughout the period of the loan, provided there is no charge in any factors on the basis of which it is calculated.

- The EMI has an interest and a principal. Through the principal, the borrower pays back the loan each month. Through the interest, he pays the bank the interest due to the loan amount.

- The EMIs are designed so that the part of the interest forms a major part of the payment made in the initial years. In the later years, the part of the principal becomes high.

- The EMI can change in case of a change in interest rates or if there is a prepayment. It is also possible to keep the EMI persistent and increase and decrease the term of the loan to reflect the changes in interest or loan payment in advance.

FAQs

1. What documents are generally required for loan approval?

In addition to all legal documents relating to the reason for the loan asked, banks will also ask you to submit. Identity and Residence Proof, latest salary slip (authenticated by the employer and self-attested for employees) and Form 16 (for business persons/self-employed) and last 6 months banks statements / Balance sheet, as applicable. You also need to submit the completed application form along with your photograph.

2. How does Tenure affect the cost of the loan?

The longer the tenure of the loan, the lesser will be your monthly EMI outflow. Shorter tenures mean a greater EMI burden, but your loan is repaid faster. If you have a short term cash flow for mismatch, your bank may increase the tenure of the loan, and your EMI burden comes down. But longer tenures mean payment of larger interests towards the loan and make it more expensive.

3. How many types of EMI are there?

There are two types of EMI payments that a borrower can choose to make:

- EMI in advance

- EMI in arrears

4. What are the difference between EMI in advance and EMI in arrears?

EMI in advance is also known as Advance EMI where the first payment is made in advance to the bank wherein the principal amount minus the processing fee and the first EMI amount is paid by the borrower's bank account.

Whereas, EMI in Arrears also known as standard EMI where the borrower has to make EMI payments at the end of each month over a specified loan scheme is ideal if you don't have sufficient funds to made a down payment on a car of your choice.

5. What does EMI depend on?

EMI of a loan depends on three factors:

- Loan amount

- Interest rate

- Tenure of loan

6. How is EMI calculated?

The mathematical formula to calculate EMI is:

EMI = P x u x (1 + r) n / ((1 + r) n-1

where,

P = Loan amount

r = Rate of interest

n = Tenure in number of months